October saw hyper gains for US equities, then a moderate retrace to form a higher low in November to sp'2019. December has already started on a significantly positive note, back into the 2100s. Underlying price momentum continues to swing back toward the equity bulls.

sp'monthly9

Summary

Eyes on the MACD (blue bar histogram) cycle, which is now ticking higher for the third consecutive month.

At the current rate, the sp'500 will see a bullish MACD cross in late Feb/early March.

--

If we do see MARCON turn back to 7 in spring 2016, it then has to be asked, will 2016 finally see the hyper-upside that I had originally expected to see from summer 2015 onward?

In my view.. it will be necessary to see the Fed regularly raise rates - at least once a quarter, and at the same time, GDP/jobs data will need to remain at least 'reasonable'.

For the moment... holding at MARCON 6.

Tuesday, 1 December 2015

Friday, 16 October 2015

Remaining broadly bearish

Despite being net higher for October by 113pts (5.9%) at sp'2033, the monthly cycles remain outright bearish. Equity bears need to restrain the current rally to a monthly close no higher than the 10MA in the 2040s. Any monthly close in the 2050/60s will open the door to new historic highs into early 2016.

sp'monthly9

Summary

Without question things are now extremely borderline.

Based on past grand multi-year cycles, so long as the bears can hold the market for a monthly close under the monthly 10MA, things can be considered as still broadly bearish.

Indeed, the underlying MACD (blue bar histogram) cycle remains deeply negative, and will very likely stay negative until January.. even if the market can climb into the sp'2100s.

*as ever.. it will be important to consider other indexes... along with other world markets.

--

For the moment... holding at MARCON 6

sp'monthly9

Without question things are now extremely borderline.

Based on past grand multi-year cycles, so long as the bears can hold the market for a monthly close under the monthly 10MA, things can be considered as still broadly bearish.

Indeed, the underlying MACD (blue bar histogram) cycle remains deeply negative, and will very likely stay negative until January.. even if the market can climb into the sp'2100s.

*as ever.. it will be important to consider other indexes... along with other world markets.

--

For the moment... holding at MARCON 6

Monday, 31 August 2015

Increasingly bearish

With a net monthly decline of -131pts (6.3%) at sp'1972, US equity indexes are increasingly bearish. Regardless of any continued bounce into mid September (even as high as the 2050/70 zone), there looks to be high probability that the Aug' low was not a key multi-month low.

sp'monthly9

Summary

Suffice to say, August settled with a very significant net decline of -131pts (6.3%) @ 1972, with an intra month low of 1867.

Price momentum continues to swing toward the equity bears at an accelerated rate. We've not seen price momentum this negative since June 2009.

-

The next 3-5 weeks could prove to be even wilder than the latter half of August.

-

Best case for the equity bears?

sp'weekly8

The low sp'1700s look viable in October, where they are multiple aspects of support.

sp'monthly9

Summary

Suffice to say, August settled with a very significant net decline of -131pts (6.3%) @ 1972, with an intra month low of 1867.

Price momentum continues to swing toward the equity bears at an accelerated rate. We've not seen price momentum this negative since June 2009.

-

The next 3-5 weeks could prove to be even wilder than the latter half of August.

-

Best case for the equity bears?

sp'weekly8

The low sp'1700s look viable in October, where they are multiple aspects of support.

Friday, 24 July 2015

Momentum still weakening

Despite remaining close to the May 20th historic high of sp'2134, underlying price momentum continues to weaken. A break under the giant 2K threshold looks due into the late summer.

sp'monthly9

Summary

Suffice to say, this is the longest MARCON'6 period since the intermediate correction of late 2011.

Ironically, unlike 2011, actual prices remain a mere 2-3% below the recent historic high.

-

Best guess... increasing weakness from mid August-early October. From there... renewed upside.. with the MACD (blue bar histogram) cycle ticking higher from October/November onward into 2016.

sp'monthly9

Summary

Suffice to say, this is the longest MARCON'6 period since the intermediate correction of late 2011.

Ironically, unlike 2011, actual prices remain a mere 2-3% below the recent historic high.

-

Best guess... increasing weakness from mid August-early October. From there... renewed upside.. with the MACD (blue bar histogram) cycle ticking higher from October/November onward into 2016.

Monday, 1 June 2015

Momentum continues to weaken

Despite a net monthly gain, along with a new historic high of 2134 for the sp'500 in May, underlying momentum is continuing to swing (if slowly) back toward the equity bears.

sp'monthly9

Summary

Underlying MACD (blue bar histogram) has started a new month by ticking lower again, and is now negative cycle for the fourth consecutive month.

Even if renewed strength to the sp'2160/80 zone in mid/late June, momentum will remain moderately negative, and certainly favours the equity bears.

A sig' retrace for US/world markets looks due this summer/early autumn.

From there, renewed upside into 2016.. and probably all the way into 2017 looks probable.

sp'monthly9

Summary

Underlying MACD (blue bar histogram) has started a new month by ticking lower again, and is now negative cycle for the fourth consecutive month.

Even if renewed strength to the sp'2160/80 zone in mid/late June, momentum will remain moderately negative, and certainly favours the equity bears.

A sig' retrace for US/world markets looks due this summer/early autumn.

From there, renewed upside into 2016.. and probably all the way into 2017 looks probable.

Friday, 1 May 2015

Momentum still weakening

Despite a significant net daily gain of 1.1% into the weekly close, the new month has seen underlying momentum swing a little further to the downside. However, it would seem rather than lower prices, the market is simply in a period of consolidating across time.

sp'monthly9

Summary

It is indeed somewhat ironic that despite the MACD (blue bar histogram) cycle at levels not seen since Dec' 2011, the actual index levels remain at/close to historic highs.

It will likely require upside to the sp'2150/75 zone.. before we see a bullish cross on the monthly cycle... and that looks unlikely in May... a seasonally weak month.

With the sp' @ 2108, holding at MARCON 6.

sp'monthly9

Summary

It is indeed somewhat ironic that despite the MACD (blue bar histogram) cycle at levels not seen since Dec' 2011, the actual index levels remain at/close to historic highs.

It will likely require upside to the sp'2150/75 zone.. before we see a bullish cross on the monthly cycle... and that looks unlikely in May... a seasonally weak month.

With the sp' @ 2108, holding at MARCON 6.

Friday, 24 April 2015

Still holding a bearish cross

Despite new historic highs, the monthly MACD cross is holding on a number of indexes.. including the sp'500. However, equity bears face further problems as the USD looks in the process of retracing lower into June. A weaker US Dollar certainly bodes in favour of continued upside.

sp'monthly9

Summary

Little to add.

The broader US equity market remains pretty strong, as also reflected in most EU/Asia markets.

-

So.. .holding at MARCON 6, but if sp'2130/40s into early May.. the status will turn back to an outright bullish 7.

sp'monthly9

Summary

Little to add.

The broader US equity market remains pretty strong, as also reflected in most EU/Asia markets.

-

So.. .holding at MARCON 6, but if sp'2130/40s into early May.. the status will turn back to an outright bullish 7.

Tuesday, 31 March 2015

March settles moderately bearish

With weakness into the Tuesday close, March settled with a bearish MACD cross for the sp'500 (and most other US indexes). Near term momentum now slightly favours the equity bears. First downside target is the 200dma in the sp'2010s, and then weekly support in the mid 1900s.

sp'monthly9

Summary

Little to add.

It has been a mixed opening quarter to 2015.

January was bearish.. and settled at MARCON 6, only to see February with relative hyper-gains.. hitting new historic highs on most indexes..back to MARCON 7.

March has flipped lower.. and we have a moderately bearish MACD cross on most indexes... back to MARCON 6.

All things considered.. the broader trend remains UP.. but there remains a viable intermediate down wave.

Best 'doomer bear' case for the summer is Dow 15k.. along with sp'1700s. For now though, those remain mere 'wistful hopes', as there are a truckload of support levels all the way into the mid sp'1900s.

sp'monthly9

Summary

Little to add.

It has been a mixed opening quarter to 2015.

January was bearish.. and settled at MARCON 6, only to see February with relative hyper-gains.. hitting new historic highs on most indexes..back to MARCON 7.

March has flipped lower.. and we have a moderately bearish MACD cross on most indexes... back to MARCON 6.

All things considered.. the broader trend remains UP.. but there remains a viable intermediate down wave.

Best 'doomer bear' case for the summer is Dow 15k.. along with sp'1700s. For now though, those remain mere 'wistful hopes', as there are a truckload of support levels all the way into the mid sp'1900s.

Wednesday, 25 March 2015

.. and another bearish cross

With the failure to hold the retrace low of sp'2085... the monthly cycles have yet again seen a bearish MACD cross. Broader price action still doesn't particularly support the equity bears.. unless sustained trading under the giant sp'2k threshold.

sp'monthly9

Summary

Little to add.

Yet again.. another little down wave.. from sp'2114 to 2061.. and the monthly cycle has turned moderately bearish.

As ever.. how we close the month is far more important.

sp'monthly9

Summary

Little to add.

Yet again.. another little down wave.. from sp'2114 to 2061.. and the monthly cycle has turned moderately bearish.

As ever.. how we close the month is far more important.

Friday, 20 March 2015

Back to bullish... again

With the market battling into the sp'2100s, the bigger monthly MACD cycle has again flipped bullish... offering a super bullish MARCON 7. With ECB QE, along with recent historic breakouts in the UK and China markets, there is little reason to expect any hope of a moderate correction until at least May/June.

sp'monthly9

Summary

Little to add.

March looks set to close at MARCON 7... along with powerful net monthly gains for most US and world equity markets.

sp'monthly9

Summary

Little to add.

March looks set to close at MARCON 7... along with powerful net monthly gains for most US and world equity markets.

Broader trend somewhat twitchy

With just a minor daily decline of sp -10pts @ 2089, the monthly MACD cycle has again seen a bearish cross. However, the recent post FOMC gains look very solid, and market should be able to climb higher into end month.

sp'monthly'9

Summary

Little to add.

I do NOT see the market breaking below the 50dma of sp'2063. Right now, a March close in the sp'2100s looks probable... which would turn the monthly cycle back to bullish.

So.. MARCON 6.... but 7 looks due tomorrow... or next week.

sp'monthly'9

Summary

Little to add.

I do NOT see the market breaking below the 50dma of sp'2063. Right now, a March close in the sp'2100s looks probable... which would turn the monthly cycle back to bullish.

So.. MARCON 6.... but 7 looks due tomorrow... or next week.

Wednesday, 18 March 2015

Back to outright bullish

With US capital markets 'inspired' by the latest FOMC statement, equities soared back into the sp'2100s, which has resulted in the bigger monthly MACD cycle turning back to outright bullish. Outlook into April is bullish, and any hope of a bearish monthly close are now off the menu.

sp'monthly9

Summary

Suffice to add... Mr Market seems very pleased with the current situation, and with the USD cooling from DXY 100 to the 97s, equities look set for new historic highs.

*it is notable that the upper bollinger on the monthly is offering 2170s in the immediate term.

A fair few are seeking sp'2300s by year end... and at the current rate of trend.. that would indeed be the natural target.

sp'monthly9

Summary

Suffice to add... Mr Market seems very pleased with the current situation, and with the USD cooling from DXY 100 to the 97s, equities look set for new historic highs.

*it is notable that the upper bollinger on the monthly is offering 2170s in the immediate term.

A fair few are seeking sp'2300s by year end... and at the current rate of trend.. that would indeed be the natural target.

Friday, 13 March 2015

A bearish March close?

With continuing weakness to sp'2039 this week, the monthly MACD cycle for the sp'500 remains bearish. If the sp'500 can close March no higher than 2080, then it will bode for an intermediate bearish turn into the spring/summer.

sp'monthly9

Summary

Suffice to add... things are starting to get interesting again.

After the powerful February gains - with a new recent high of sp'2119, it had seemed the bears were toast until at least April/May... but recent weakness is causing some distinct technical damage.

If the sp'500 can take out the 200dma (2005/10 zone), next support is not until the 1950/25 zone. Clearly, that will take the better part of two weeks.. which would mean the bulls wouldn't have a hope of closing March net positive.

*ultimate 'best case' downside this late spring/summer is the lower monthly bollinger, which itself is rising each.. and every month.. currently @ 1654. By end year... core support will be pretty close to the giant 2k threshold.

-

As ever... stay tuned!

sp'monthly9

Summary

Suffice to add... things are starting to get interesting again.

After the powerful February gains - with a new recent high of sp'2119, it had seemed the bears were toast until at least April/May... but recent weakness is causing some distinct technical damage.

If the sp'500 can take out the 200dma (2005/10 zone), next support is not until the 1950/25 zone. Clearly, that will take the better part of two weeks.. which would mean the bulls wouldn't have a hope of closing March net positive.

*ultimate 'best case' downside this late spring/summer is the lower monthly bollinger, which itself is rising each.. and every month.. currently @ 1654. By end year... core support will be pretty close to the giant 2k threshold.

-

As ever... stay tuned!

Friday, 6 March 2015

Another tease to the equity bears

With the US equity market slipping from a new historic high of sp'2119, to the 2060s, the giant monthly cycle has once again seen a MACD bearish cross. However.. this is very likely just another cruel tease to the infamous 'doomer bears'.... with another wave higher due.

sp'monthly'9

Summary

Suffice to add... I don't think we'll see sustained trading under sp'2050 in the current wave. More likely.. we'll claw higher into end March.. and across April.

MARCON 6.... but set to close the month at 7.

sp'monthly'9

Summary

Suffice to add... I don't think we'll see sustained trading under sp'2050 in the current wave. More likely.. we'll claw higher into end March.. and across April.

MARCON 6.... but set to close the month at 7.

Thursday, 12 February 2015

Back to outright bullish

We're barely half way into February, and already holding powerful net monthly gains of 93pts (4.7%) @ sp'2088. The monthly MACD cycle has negated the bearish cross of late January, and has now turned positive cycle.

sp'monthly

Summary

What can be said? Market appears back in 100% 'everything is fine' mood, and we now have bullish engulfing candles on most of the indexes.

Without question.. if we close the month >sp'2088, it'll bode for continued upside across the spring.. if not the year.

For the equity bears... it would seem that the late January weakness was just another cruel tease.

sp'monthly

Summary

What can be said? Market appears back in 100% 'everything is fine' mood, and we now have bullish engulfing candles on most of the indexes.

Without question.. if we close the month >sp'2088, it'll bode for continued upside across the spring.. if not the year.

For the equity bears... it would seem that the late January weakness was just another cruel tease.

Monday, 2 February 2015

Downside momentum building

A new month has begun with further dynamic swings in the US equity indexes. With January closing with a bearish MACD cross... February is seeing underlying price momentum increasingly swinging in favour of the equity bears.

sp'monthly'9

Summary

Little to add.

What is important... unlike October.. the bears finally managed a bearish monthly close for January.

If Feb' can close at least a little lower, it'd make for the third consecutive monthly decline... and would be highly suggestive of a much bigger move to the low sp'1700s.

First things first though... lets see if the bears can hit 1920/00 within the next 9 trading days. It won't be easy, but then... when the 200dma was lost in early October... things unravelled rather fast.

sp'monthly'9

Summary

Little to add.

What is important... unlike October.. the bears finally managed a bearish monthly close for January.

If Feb' can close at least a little lower, it'd make for the third consecutive monthly decline... and would be highly suggestive of a much bigger move to the low sp'1700s.

First things first though... lets see if the bears can hit 1920/00 within the next 9 trading days. It won't be easy, but then... when the 200dma was lost in early October... things unravelled rather fast.

Friday, 30 January 2015

January ends on a bearish note

After a number of brief bearish teases since last October, the equity bears have finally achieved the first bearish monthly close on the sp'500 since Jan'2012, resulting in MARCON 6. Outlook in the immediate term is now bearish, with the door opening to the sp'1920/00 zone by mid February.

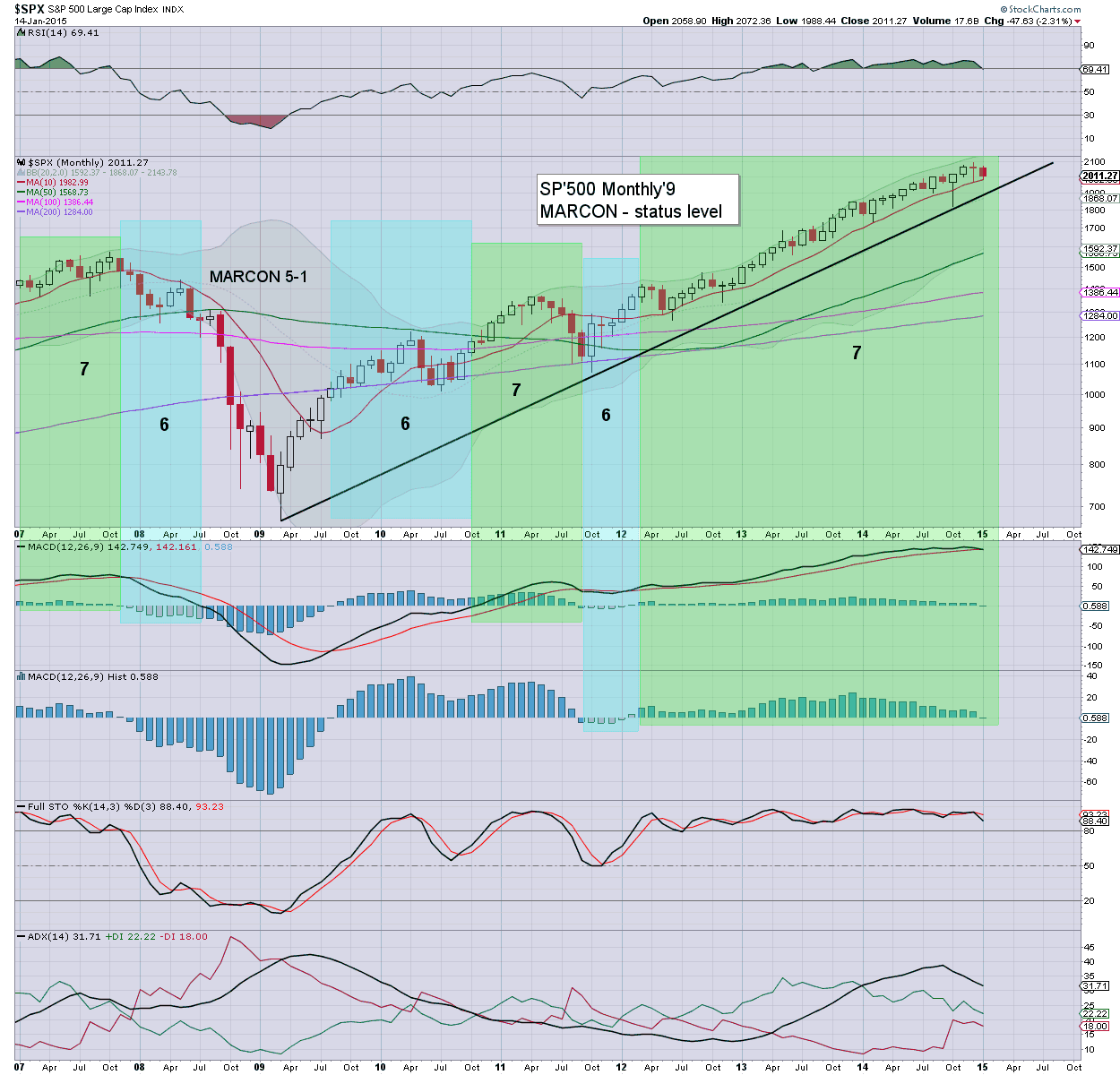

sp'monthly9 - MARCON status

Summary

It has been THREE full years of waiting.. and finally, the equity bears have achieved a bearish monthly cross on the sp'500.

Certainly, the primary up trend is STILL intact, but the January close was particularly weak.

Next support is the double micro floor of 1988.... after that... 1973/75 - where the 200dma is lurking. Any daily closes under there.. will open up the 1920/00 zone by mid February. The latter would likely equate to VIX in the mid/upper 30s.

sp'monthly9 - MARCON status

Summary

It has been THREE full years of waiting.. and finally, the equity bears have achieved a bearish monthly cross on the sp'500.

Certainly, the primary up trend is STILL intact, but the January close was particularly weak.

Next support is the double micro floor of 1988.... after that... 1973/75 - where the 200dma is lurking. Any daily closes under there.. will open up the 1920/00 zone by mid February. The latter would likely equate to VIX in the mid/upper 30s.

Friday, 16 January 2015

Back to outright bullish

With significant gains into the long weekend, the monthly MACD cycle on the sp'500 has lost its bearish cross, and is back to outright bullish. As has been the case since October, the equity bears are being periodically teased by Mr Market... and so far.... still no conclusive bearish monthly closes.

sp'monthly9

Summary

Little to add.

Back to MARCON 7, and with the ECB set to announce major QE next Thursday, January could yet close net positive.

As ever... it is how we close the month that matters.

sp'monthly9

Summary

Little to add.

Back to MARCON 7, and with the ECB set to announce major QE next Thursday, January could yet close net positive.

As ever... it is how we close the month that matters.

Thursday, 15 January 2015

Provisional warning of trouble

With a daily close of sp'1992, the monthly cycle settled the day with a bearish MACD cross. That has happened barely 4 or 5 times since mid October. If January closes negative cycle, we'll have the first confirmed monthly bearish close since Jan'2012.

sp'monthly9

Summary

Suffice to add.... how we close the month.. that is what matters.

-

*ohh, for those of you wondering, yes, I'm aware that the Dow and R2K have been the equivalent of MARCON 6 for some months, but I try to focus on just the sp'500. I simply do not have the time to cover all the indexes.

sp'monthly9

Summary

Suffice to add.... how we close the month.. that is what matters.

-

*ohh, for those of you wondering, yes, I'm aware that the Dow and R2K have been the equivalent of MARCON 6 for some months, but I try to focus on just the sp'500. I simply do not have the time to cover all the indexes.

Wednesday, 14 January 2015

US equities again flirting with a major turn

With the break back under the giant sp'2000 threshold, the monthly MACD cycle has given a bearish cross.. the first sign of a broader trend change. Yet... the same event happened in mid October, only to last a few days. A mere week ago... MARCON' 6 was hit... but held for mere hours.

sp'monthly9, 8yr

Summary

*with the market clawing into the Wednesday close, the monthly cycles negated the bearish cross from earlier today.

--

Suffice to say, the equity bears have been teased a fair few times since the autumn.

As ever.. its not so much the intra-month action.. but how we close the month.

Considering the ECB are set to announce QE - t-bond buying next Thursday, I would not expect the monthly cycle to remain negative (MARCON 6) at the close of January.

Holding at MARCON 7

Summary

*with the market clawing into the Wednesday close, the monthly cycles negated the bearish cross from earlier today.

--

Suffice to say, the equity bears have been teased a fair few times since the autumn.

As ever.. its not so much the intra-month action.. but how we close the month.

Considering the ECB are set to announce QE - t-bond buying next Thursday, I would not expect the monthly cycle to remain negative (MARCON 6) at the close of January.

Holding at MARCON 7

Subscribe to:

Comments (Atom)