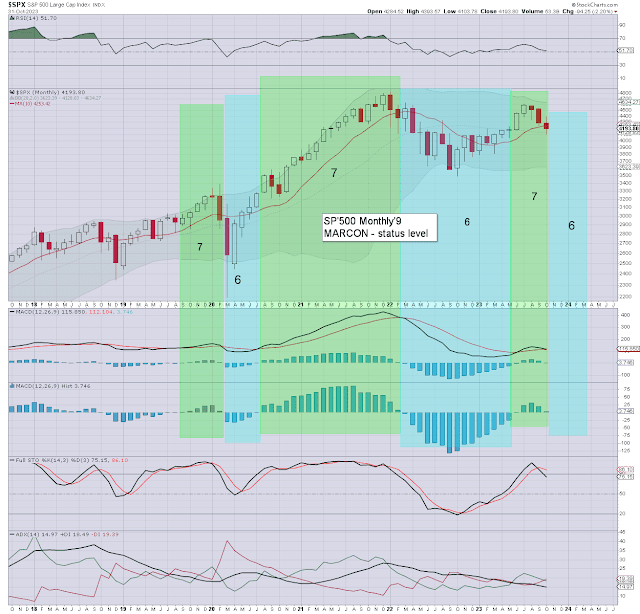

Summary

The SPX saw a net December gain of +202pts (4.4%) to 4769, another monthly settlement above the key 10MA (4382), as the m/t trend remains bullish. Net 2023 gain of 930.33pts (24.2%).

Momentum

ticked upward for a second month, settling moderately positive. S/t bullish in early January 2024. M/t bullish from the Oct'2022 low. The latter arguably only changes if a monthly settlement back under the key 10MA, which will be in the low/mid 4400s in January.

For more of the same...

For details and the latest subscription offers >>> https://www.tradingsunset.com