Summary

The SPX ended the year on a positive note,

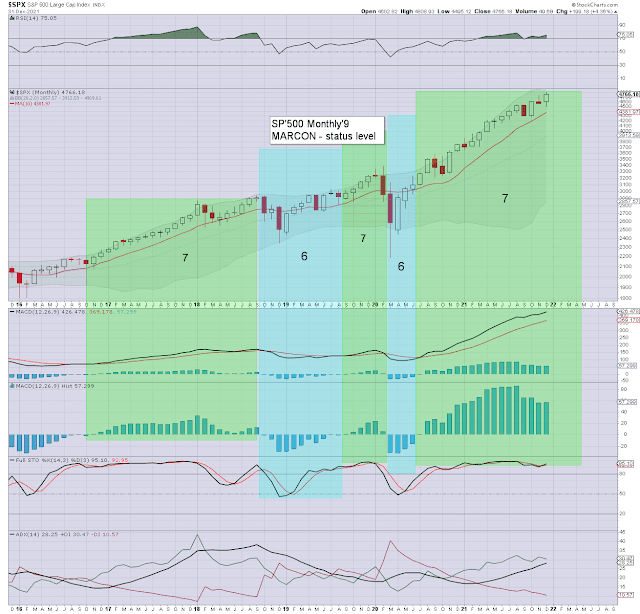

settling net higher for December by +199pts (4.4%) to 4766, having printed a new historic high of 4808. The December candle is bullish engulfing and leans distinctly s/t bullish.

For the year, the SPX saw a net gain of 1010.11pts (26.9%). The

m/t bullish trend could be expected

to continue into (at least) April/May.

I would note the key 10MA at 4381,

which will jump/adjust to the mid 4400s as of the January 3rd open. Monthly price momentum ticked subtly upward in December, and remains on the high side. Even if momentum cools back, it should remain net positive until at least April/May.

Holding at MARCON 7.