Summary

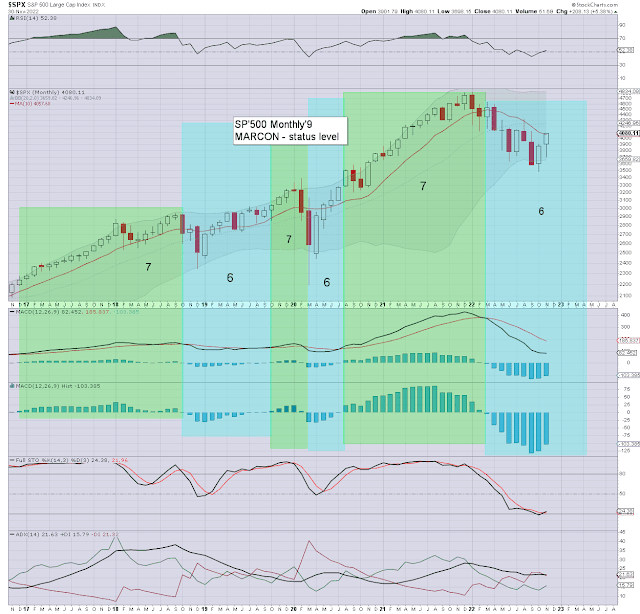

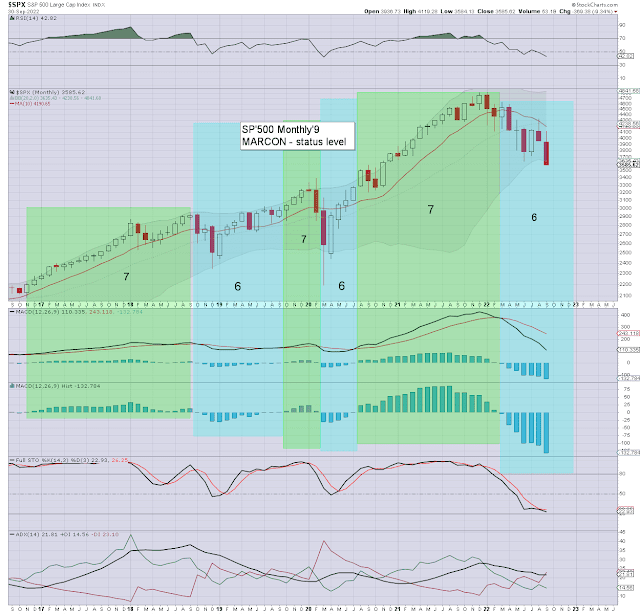

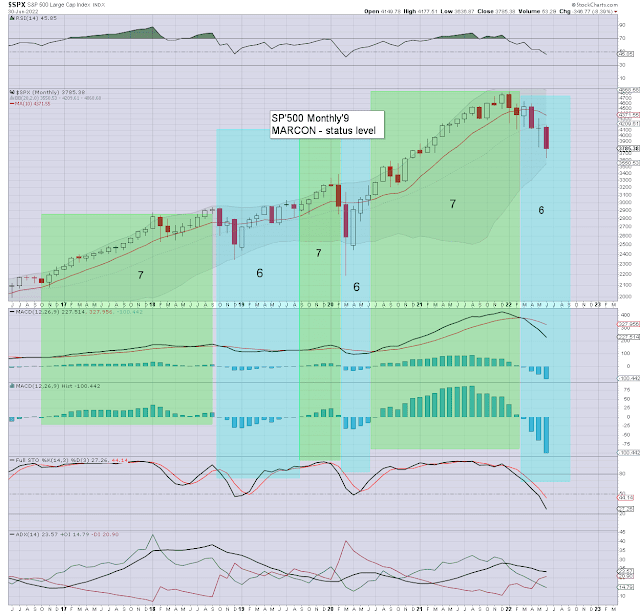

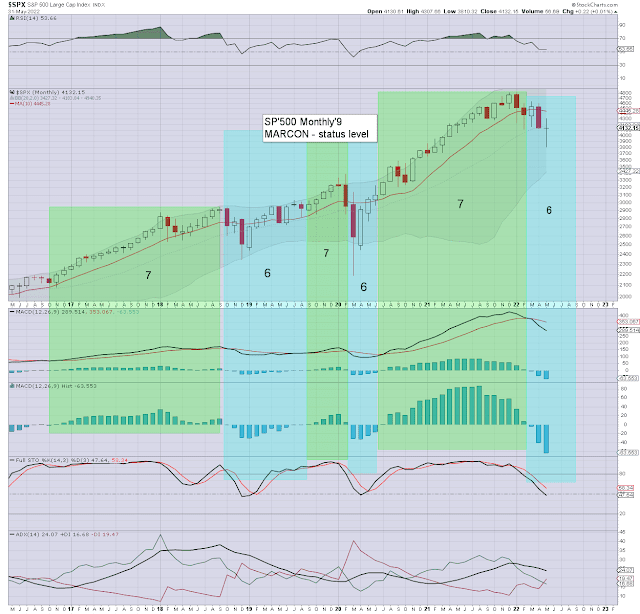

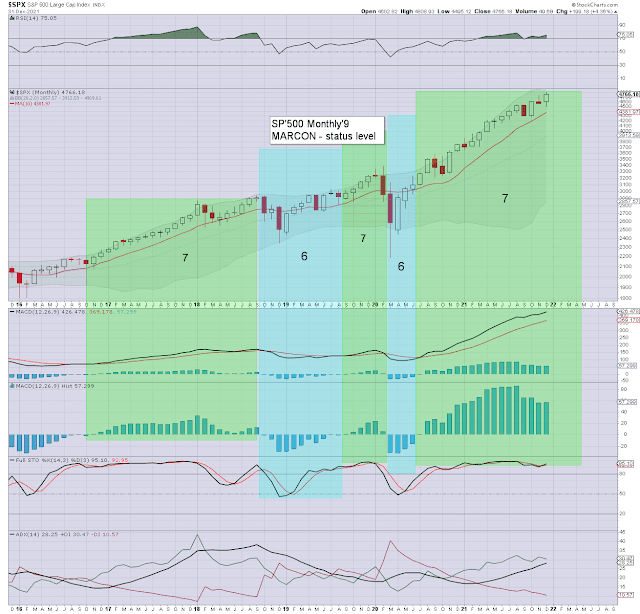

The SPX saw a net December decline of -240pts (5.9%) to 3839, notably back under the 10MA (4004). Momentum subtly ticked upward for a third consecutive month, but remains on the very low side.

With a decisive monthly/yearly settlement <4K, the US equity market is to be seen as back to m/t bearish. Equity bulls have nothing to tout unless the recent double top of 4100 is cleared, and that doesn't look realistic within H1 of 2023.

--

For more of the same...

For details and the latest offers >>> https://www.tradingsunset.com