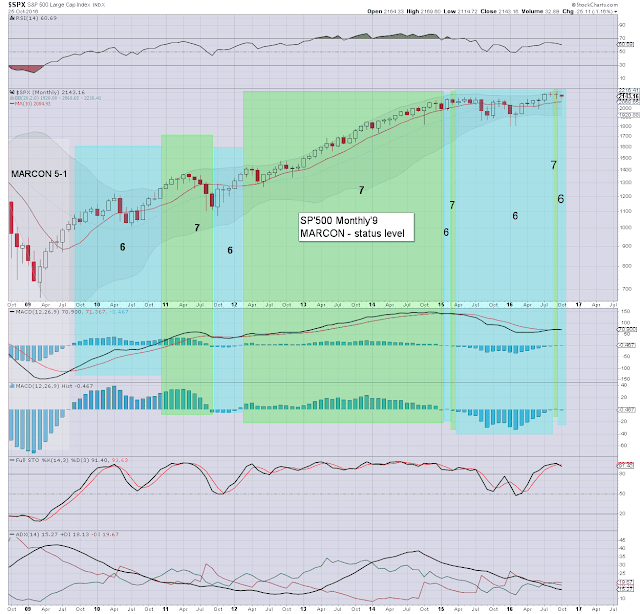

With moderate weakness to sp'2143, price momentum on the giant monthly cycle is back to fractionally negative. Outlook remains bearish into early November.

sp'monthly9

Summary

Little to add.

Equity bears should be battling for an October close under the 10MA (currently 2084)... but that looks out of range, considering there are just 4 trading days left.

Lets just see how we close the month.

Tuesday, 25 October 2016

Choppy October

With moderate gains to start the week, price momentum on the giant monthly cycle is back to fractionally positive. Near term outlook though, is for renewed cooling into early November.

sp'monthly

Summary

Suffice to add... back to outright bullish..... if only for a day or two.

Market looks vulnerable into early November.

Right now... a monthly close at MARCON 6 looks probable.... aka... prices somewhere <2140 or so.

sp'monthly

Summary

Suffice to add... back to outright bullish..... if only for a day or two.

Market looks vulnerable into early November.

Right now... a monthly close at MARCON 6 looks probable.... aka... prices somewhere <2140 or so.

Wednesday, 12 October 2016

A little shaky in October

With US equities trading back to the sp'2120s - with VIX 16s, price momentum on the giant monthly cycle has cooled a little. It will be important for the equity bulls to achieve renewed upside.

sp'monthly9

Summary

Suffice to add... underlying MACD cycle is back to moderately negative.... aka.. MARCON 6.

A failure to keep pushing higher - at the zero threshold, would be especially bearish.

Lets see how the month settles.

sp'monthly9

Summary

Suffice to add... underlying MACD cycle is back to moderately negative.... aka.. MARCON 6.

A failure to keep pushing higher - at the zero threshold, would be especially bearish.

Lets see how the month settles.

Subscribe to:

Comments (Atom)