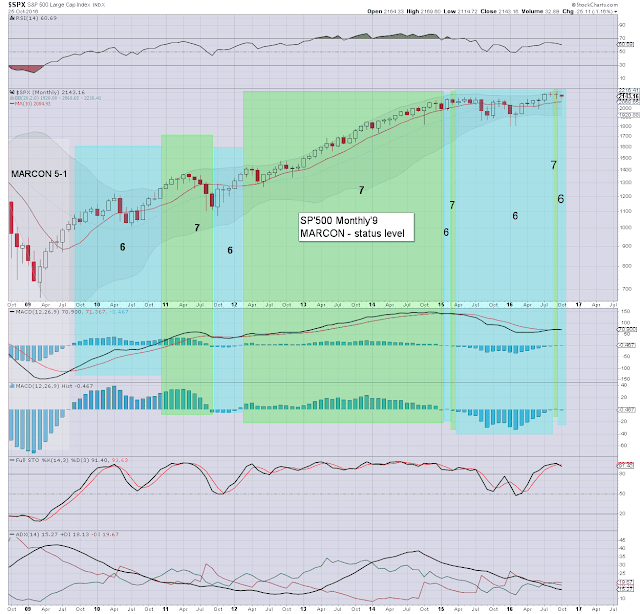

With a quartet of new index historic highs - including sp'500 @ 2198, underlying price momentum on the giant monthly cycle has turned back to outright bullish.

sp'monthly9

Summary

Little to add, as the main market is now regularly breaking new historic highs in 4 of 6 indexes. The NYSE comp' and Transports look set to follow in early 2017.

Short term, the upper bollinger is offering the 2230s, with the 2250s seemingly viable by year end. The 2300s look out of range until early 2017.

Monday, 21 November 2016

Tuesday, 25 October 2016

Renewed weakness

With moderate weakness to sp'2143, price momentum on the giant monthly cycle is back to fractionally negative. Outlook remains bearish into early November.

sp'monthly9

Summary

Little to add.

Equity bears should be battling for an October close under the 10MA (currently 2084)... but that looks out of range, considering there are just 4 trading days left.

Lets just see how we close the month.

sp'monthly9

Summary

Little to add.

Equity bears should be battling for an October close under the 10MA (currently 2084)... but that looks out of range, considering there are just 4 trading days left.

Lets just see how we close the month.

Choppy October

With moderate gains to start the week, price momentum on the giant monthly cycle is back to fractionally positive. Near term outlook though, is for renewed cooling into early November.

sp'monthly

Summary

Suffice to add... back to outright bullish..... if only for a day or two.

Market looks vulnerable into early November.

Right now... a monthly close at MARCON 6 looks probable.... aka... prices somewhere <2140 or so.

sp'monthly

Summary

Suffice to add... back to outright bullish..... if only for a day or two.

Market looks vulnerable into early November.

Right now... a monthly close at MARCON 6 looks probable.... aka... prices somewhere <2140 or so.

Wednesday, 12 October 2016

A little shaky in October

With US equities trading back to the sp'2120s - with VIX 16s, price momentum on the giant monthly cycle has cooled a little. It will be important for the equity bulls to achieve renewed upside.

sp'monthly9

Summary

Suffice to add... underlying MACD cycle is back to moderately negative.... aka.. MARCON 6.

A failure to keep pushing higher - at the zero threshold, would be especially bearish.

Lets see how the month settles.

sp'monthly9

Summary

Suffice to add... underlying MACD cycle is back to moderately negative.... aka.. MARCON 6.

A failure to keep pushing higher - at the zero threshold, would be especially bearish.

Lets see how the month settles.

Friday, 30 September 2016

The bullish September settlement

With equities climbing into the monthly/Q3 close, price momentum on the giant monthly cycle turned positive. The September settlement was the most bullish since Feb'2015.

sp'monthly9

Summary

September was the first monthly settlement with the MACD (blue bar histogram) in positive territory since Feb'2015. Its pretty significant, and confirms the underlying market upside seen since the Jan/Feb' lows.

In theory, the market could battle all the way into spring 2017.

First soft target is the upper bollinger, which in early Oct' will be somewhere around sp'2210.

Things only turn bearish with sustained price action below the monthly 10MA, which is currently @ 2075.

sp'monthly9

Summary

September was the first monthly settlement with the MACD (blue bar histogram) in positive territory since Feb'2015. Its pretty significant, and confirms the underlying market upside seen since the Jan/Feb' lows.

In theory, the market could battle all the way into spring 2017.

First soft target is the upper bollinger, which in early Oct' will be somewhere around sp'2210.

Things only turn bearish with sustained price action below the monthly 10MA, which is currently @ 2075.

Thursday, 29 September 2016

DB spooking the market lower

With DB spooking the US equity market, resulting in broad net daily declines, price momentum on the giant monthly cycle has turned back to fractionally negative.

sp'monthly9

Summary

With one trading day left of the month, underlying price momentum is back to fractionally negative.

As ever, the monthly close will be important, although having broadly climbed since the Jan/Feb' lows, its not absolutely necessary for the equity bulls to achieve a particularly bullish Sept'.

Clearly though, if Oct' and Nov' start to show increasing weakness... then things get interesting, as a failure at the MACD zero threshold can be the most bearish scenario.

sp'monthly9

Summary

With one trading day left of the month, underlying price momentum is back to fractionally negative.

As ever, the monthly close will be important, although having broadly climbed since the Jan/Feb' lows, its not absolutely necessary for the equity bulls to achieve a particularly bullish Sept'.

Clearly though, if Oct' and Nov' start to show increasing weakness... then things get interesting, as a failure at the MACD zero threshold can be the most bearish scenario.

Tuesday, 27 September 2016

Back to 7... again

With just a moderate net daily gain, we're back to outright bullish for the sp'500. Now its a case of where the month will settle.

--

sp'monthly9

Summary

Little to add.

Lets just see if we the market can manage a Sept' close at 7.

--

sp'monthly9

Summary

Little to add.

Lets just see if we the market can manage a Sept' close at 7.

Monday, 26 September 2016

A little cooling

With equities starting the week with broad declines... price momentum on the giant monthly cycle has turned back to fractionally negative.

sp'monthly9

Summary

Little to add.

As ever, the monthly close will be important. It would be useful to the equity bulls to see the month settle at least above sp'2170, which would likely achieve a status of MARCON 7. Indeed, its notable that the market hasn't achieved an outright bullish close since Feb' 2015.

sp'monthly9

Summary

Little to add.

As ever, the monthly close will be important. It would be useful to the equity bulls to see the month settle at least above sp'2170, which would likely achieve a status of MARCON 7. Indeed, its notable that the market hasn't achieved an outright bullish close since Feb' 2015.

Wednesday, 21 September 2016

With no rate hike, back to 7

With the Fed still refraining from raising int' rates from the current target range of 0.25-0.50%, US equities have resumed higher. The sp'2200s remain due, not least with global monthly QE of around $200bn, and continuing share buybacks.

sp'monthly9

Summary

Suffice to note... we're back to 100% bullish, as the fed continue to hold off from raising rates.

sp'monthly9

Summary

Suffice to note... we're back to 100% bullish, as the fed continue to hold off from raising rates.

Friday, 9 September 2016

Moody market

With the market finally breaking significantly lower after two months of micro chop, the monthly price momentum has ticked back to negative.

sp'monthly9

Summary

Suffice to add.... with a series of breaks of multiple support, the monthly cycles have ticked back to negative.

As ever, the monthly close will be important, and that will unquestionably be highly dependent on whether the Fed hike rates.. and how the market will react to whatever decision they make.

For the moment though... the US, and almost all other world markets are still leaning to the upside.

sp'monthly9

Summary

Suffice to add.... with a series of breaks of multiple support, the monthly cycles have ticked back to negative.

As ever, the monthly close will be important, and that will unquestionably be highly dependent on whether the Fed hike rates.. and how the market will react to whatever decision they make.

For the moment though... the US, and almost all other world markets are still leaning to the upside.

Thursday, 1 September 2016

...and back to full bullish

With the start of a new month, underlying price momentum has continued to tick higher. The US - along with most other world markets, are looking rather comfortable.

sp'monthly9

Summary

Suffice to add.... we're back to 100% bullish.

To me, things only turn bearish with any sustained price action under the key 10MA.. which is now in the sp'2070s.

A year end close in the 2300s looks increasingly probable, not least if the bears can't manage to break back under the breakout level of 2134.

sp'monthly9

Summary

Suffice to add.... we're back to 100% bullish.

To me, things only turn bearish with any sustained price action under the key 10MA.. which is now in the sp'2070s.

A year end close in the 2300s looks increasingly probable, not least if the bears can't manage to break back under the breakout level of 2134.

Wednesday, 24 August 2016

Moderate weakness

With the weakest closing hour in at least a month, the monthly MACD cycle has ticked back to negative. Broadly though... the sp'2200s remain due.

sp'monthly

Summary

Little to add.

We've back to MARCON 6... but the fact we've recently seen the 7s is testament to the very important new historic highs in the sp, dow, and nasdaq.

sp'monthly

Summary

Little to add.

We've back to MARCON 6... but the fact we've recently seen the 7s is testament to the very important new historic highs in the sp, dow, and nasdaq.

Back to 7

With a minor net daily gain of 4pts to sp'2186, the monthly MACD cycle has ticked back to fractionally positive.

sp'monthly9

--

An August close in the sp'2190/2200 zone looks... probable.

sp'monthly9

--

An August close in the sp'2190/2200 zone looks... probable.

Monday, 22 August 2016

A little choppy

With the Yellen set to appear at Jackson hole this Friday, price action is increasingly choppy. The bigger monthly MACD (blue bar histogram) cycle has ticked fractionally negative. Underlying trend remains upward though, as the sp'2200s remain due.

sp'monthly

sp'monthly

Friday, 12 August 2016

Back to 100% percent bullish

US equities continue to push upward from their Jan/Feb' 2016 lows, with new historic highs in the sp, dow, and nasdaq comp'. The market looks set to broadly hold together across the somewhat tricky time of Sept/Oct, and keep climbing all the way into spring 2017.

sp'monthly9

Summary

The Friday close of Aug'12th was the first daily close with the MACD (blue bar histogram) cycle above the zero threshold since Feb' 2015. This is a pretty bullish event, and has resulted in MARCON 7.

Price action could see sp'2170/60s at any point, and this would result in a down grade back to MARCON 6. Broadly, it does look like we'll soon be trading consistantly in the sp'2200s... so MARCON 7 looks probable for much of the rest of the year, and into 2017.

On a purely technical basis, the equity bulls are back in full control... as reflected with recent historic highs.

sp'monthly9

Summary

The Friday close of Aug'12th was the first daily close with the MACD (blue bar histogram) cycle above the zero threshold since Feb' 2015. This is a pretty bullish event, and has resulted in MARCON 7.

Price action could see sp'2170/60s at any point, and this would result in a down grade back to MARCON 6. Broadly, it does look like we'll soon be trading consistantly in the sp'2200s... so MARCON 7 looks probable for much of the rest of the year, and into 2017.

On a purely technical basis, the equity bulls are back in full control... as reflected with recent historic highs.

Thursday, 14 July 2016

The move to the upside

After a year of broad price chop - spanning from sp'2134 to 1810, the market has picked a direction, and its to the upside. Further gains to the sp'2200s look due in Aug/September, which should equate to Dow 18800/900s.

sp'monthly

Dow'monthly

Summary

Note the MACD (blue bar histogram) cycle for the Dow, set to turn positive as early as the latter half of July, or more viable, at the August 1st open.

Similarly, the sp'500 is set for a bullish MACD cross in early August.

... and that will take us back to MARCON 7.

sp'monthly

Dow'monthly

Summary

Note the MACD (blue bar histogram) cycle for the Dow, set to turn positive as early as the latter half of July, or more viable, at the August 1st open.

Similarly, the sp'500 is set for a bullish MACD cross in early August.

... and that will take us back to MARCON 7.

Friday, 1 July 2016

A big move remains due

Despite another hyper-ramp from sp'1991 to 2108, it likely marks another failure for the equity bulls to break above the May 2015 high of 2134. The bigger monthly charts are clear, having traded within a narrow range for over a year... a big move remains due.

sp'monthly9

sp'monthly7

Summary

Note the narrow range bollinger bands. As many in the mainstream recognise, a big breakout is due...one way or another.

-

re: Ichimoku. Things only get interesting for the deflationary doomer bears, on a pierce into the green cloud.. which is around sp'1690. By October, that will have risen to around 1770.

A break into the cloud will offer a washout to at least the 1625/1575 zone.

Any monthly close - in the remainder of 2016, under sp'1500, would bode in favour of the 'crazy talk' targets... sp'600/500 in 2017/18. However, I don't see that as viable, as the central banks would massively intervene.

sp'monthly9

sp'monthly7

Summary

Note the narrow range bollinger bands. As many in the mainstream recognise, a big breakout is due...one way or another.

-

re: Ichimoku. Things only get interesting for the deflationary doomer bears, on a pierce into the green cloud.. which is around sp'1690. By October, that will have risen to around 1770.

A break into the cloud will offer a washout to at least the 1625/1575 zone.

Any monthly close - in the remainder of 2016, under sp'1500, would bode in favour of the 'crazy talk' targets... sp'600/500 in 2017/18. However, I don't see that as viable, as the central banks would massively intervene.

Friday, 20 May 2016

Still leaning bearish

Equity price action remains broadly stuck since US indexes maxed out across late 2014-summer 2015. Underlying price momentum continues to slightly favour the equity bears, as the equity bulls are unable to find a valid excuse to buy into the sp'2100s.

sp'monthly9

sp'monthly7 - Ichimoku

Summary

Equity price since mid April has been broadly similar to that seen last Nov/Dec' 2015.

For now, price action is pretty subdued, with the sp'500 having cooled from 2111 to 2025. Near term.. there is high threat of 2000/1990s... or a slightly more dynamic H/S suggestive target of the 1970/60s.

Those are all relatively minor moves though.

The bigger weekly cycles are suggestive of a more significant break lower in late May, with broader weakness across June. The fact there is a rather key BREXIT vote (June 23rd) would likely give the market an excuse to sell lower... further pressured by seasonal factors.

--

re: monthly7. It is notable that across this coming June, the upper part of the cloud (Green) will be around 1660.

Unless equity bears can pierce the cloud - as happened in July 2008, even if the market is seriously rattled this summer, there is very high probability that the market will powerfully rebound, with new historic highs (at least in the leading indexes - sp'500, Dow, Nasdaq) by end year/early 2017.

-

Holding at MARCON 6.

sp'monthly9

sp'monthly7 - Ichimoku

Summary

Equity price since mid April has been broadly similar to that seen last Nov/Dec' 2015.

For now, price action is pretty subdued, with the sp'500 having cooled from 2111 to 2025. Near term.. there is high threat of 2000/1990s... or a slightly more dynamic H/S suggestive target of the 1970/60s.

Those are all relatively minor moves though.

The bigger weekly cycles are suggestive of a more significant break lower in late May, with broader weakness across June. The fact there is a rather key BREXIT vote (June 23rd) would likely give the market an excuse to sell lower... further pressured by seasonal factors.

--

re: monthly7. It is notable that across this coming June, the upper part of the cloud (Green) will be around 1660.

Unless equity bears can pierce the cloud - as happened in July 2008, even if the market is seriously rattled this summer, there is very high probability that the market will powerfully rebound, with new historic highs (at least in the leading indexes - sp'500, Dow, Nasdaq) by end year/early 2017.

-

Holding at MARCON 6.

Tuesday, 8 March 2016

Remaining broadly bearish

Despite the sp'500 clawing from the Feb'11th low of 1810 to 2009, the giant monthly cycles remain outright bearish. Unless the equity bulls can attain a monthly close above the monthly 10MA (currently 2011), the broader bearish outlook for spring/summer 2016 remains on track

sp'monthly9

Summary

So... we're still at MARCON 6.

Underlying MACD (blue bar histogram) is currently ticking higher, as the market has seen a considerable rally into March. Yet.. it is very probable that it is a classic bear market rally, with much lower levels this spring and into the summer.

At the current rate, with the MACD (black line) at 52.354, we won't see a move below the key zero threshold until late May/June.

--

Ichimoku - an update

I thought I'd highlight the Ichimoku chart...

sp'monthly7

For those that like the 2007/09 pattern, equity bears should be battling to pierce the top of the green cloud.. which in April will be within the 1650/25 zone.

Any price action <1600 should sound major alarm bells.

An April/May monthly close inside the green cloud will open the door to a FULL retrace of the gains since 2011.. back to the 1100/1000 zone.

--

Holding at MARCON 6

sp'monthly9

Summary

So... we're still at MARCON 6.

Underlying MACD (blue bar histogram) is currently ticking higher, as the market has seen a considerable rally into March. Yet.. it is very probable that it is a classic bear market rally, with much lower levels this spring and into the summer.

At the current rate, with the MACD (black line) at 52.354, we won't see a move below the key zero threshold until late May/June.

--

Ichimoku - an update

I thought I'd highlight the Ichimoku chart...

sp'monthly7

For those that like the 2007/09 pattern, equity bears should be battling to pierce the top of the green cloud.. which in April will be within the 1650/25 zone.

Any price action <1600 should sound major alarm bells.

An April/May monthly close inside the green cloud will open the door to a FULL retrace of the gains since 2011.. back to the 1100/1000 zone.

--

Holding at MARCON 6

Saturday, 2 January 2016

Wall Street, we have a problem

US - and most other world equity markets, saw a very strong rebound from the late summer lows. Yet, the Dec' close was a pretty ugly one. Upward price momentum has stalled, price structure is offering a giant bear flag. If January fails to close significantly higher, US and world equity markets are in real trouble.

With 2015 now wrapped up, I wanted to highlight a few things.

As ever.... for the big/serious money, its not about the intraday or even day to day action. The weekly and monthly closes are what really matter.

*I'll stick to highlighting the sp'500, as it broadly applies to most of the other indexes. It is notable of course that the 'old leader' - Transports, is far weaker, which is especially ironic (and bearish) considering the consistently low fuel prices.

--

sp'monthly1b

The issue of the monthly 10MA is something I have been incessantly highlighting lately. The Dec' close sure was a major problem for those equity bulls who were hoping to end the year at least fractionally higher.

Yes, the sp'500 only saw a net decline of -1.7% @ 2043, but that was indeed under the 10MA... and 91pts below the May high of 2134.

Right now, new historic highs look out of range until mid Feb' at the earliest, and that would assume no further weakness in early January.

--

sp'monthly3b

A rather appropriate blue candle, after the bullish greens of Oct/Nov. Equity bears should be seeking a red in Jan/Feb. First natural support would be the lower monthly bollinger.. around the 1900 threshold.

sp'monthly9

Seen on the MARCON chart, we can see how we've now been at MARCON 6 for TEN months. This is pretty incredible, and is highly indicative of the market having stalled after climbing on ZIRP and QE for the better part of six years.

spmonthly7 - ichimoku

I very rarely highlight ichimoku. I'll merely note support at the red line of 1936, and the upper part of the green cloud around 1600. By April/May, the top of the cloud will be around 1650.

Any daily closes <1930 would be a red flag, and offer the 1700/1650 zone by late spring.

--

Summary

If equities fail to push back upward, with a Jan' close in the sp'2040s or lower, we'll see the MACD (blue bar histogram) cycle remain negative.

At the current rate, the actual MACD (black line) will turn negative sometime between March-May. The last time it went negative...... Sept'2008.

... and that wasn't exactly the best month for US/world equities.

-

For now... holding at MARCON 6.... but if 5 is hit in the spring/early summer, then it'll be time to sound the alarms. Until then... everything bears careful monitoring.

With 2015 now wrapped up, I wanted to highlight a few things.

As ever.... for the big/serious money, its not about the intraday or even day to day action. The weekly and monthly closes are what really matter.

*I'll stick to highlighting the sp'500, as it broadly applies to most of the other indexes. It is notable of course that the 'old leader' - Transports, is far weaker, which is especially ironic (and bearish) considering the consistently low fuel prices.

--

sp'monthly1b

The issue of the monthly 10MA is something I have been incessantly highlighting lately. The Dec' close sure was a major problem for those equity bulls who were hoping to end the year at least fractionally higher.

Yes, the sp'500 only saw a net decline of -1.7% @ 2043, but that was indeed under the 10MA... and 91pts below the May high of 2134.

Right now, new historic highs look out of range until mid Feb' at the earliest, and that would assume no further weakness in early January.

--

sp'monthly3b

A rather appropriate blue candle, after the bullish greens of Oct/Nov. Equity bears should be seeking a red in Jan/Feb. First natural support would be the lower monthly bollinger.. around the 1900 threshold.

sp'monthly9

Seen on the MARCON chart, we can see how we've now been at MARCON 6 for TEN months. This is pretty incredible, and is highly indicative of the market having stalled after climbing on ZIRP and QE for the better part of six years.

spmonthly7 - ichimoku

I very rarely highlight ichimoku. I'll merely note support at the red line of 1936, and the upper part of the green cloud around 1600. By April/May, the top of the cloud will be around 1650.

Any daily closes <1930 would be a red flag, and offer the 1700/1650 zone by late spring.

--

Summary

If equities fail to push back upward, with a Jan' close in the sp'2040s or lower, we'll see the MACD (blue bar histogram) cycle remain negative.

At the current rate, the actual MACD (black line) will turn negative sometime between March-May. The last time it went negative...... Sept'2008.

... and that wasn't exactly the best month for US/world equities.

-

For now... holding at MARCON 6.... but if 5 is hit in the spring/early summer, then it'll be time to sound the alarms. Until then... everything bears careful monitoring.

Subscribe to:

Comments (Atom)