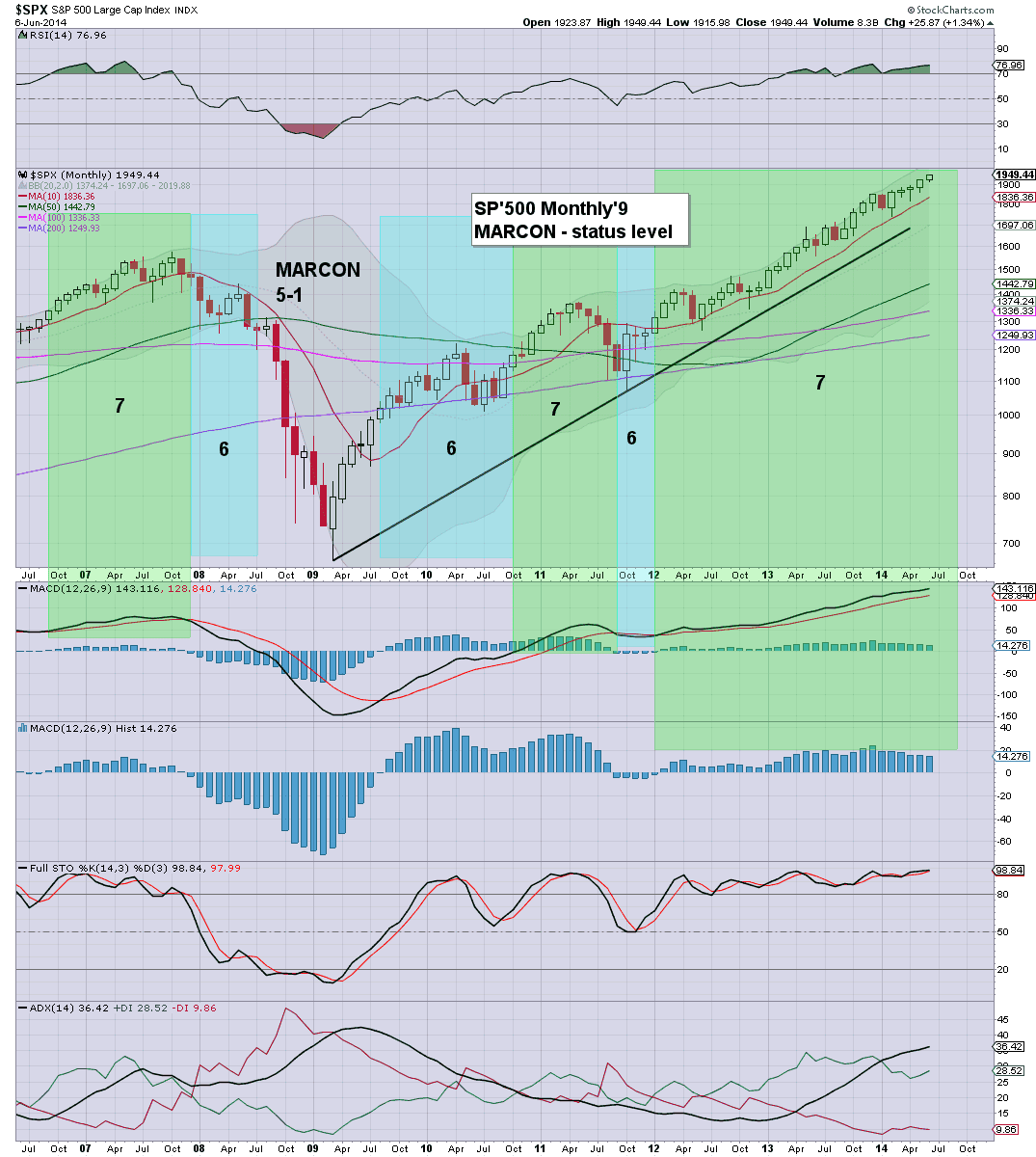

The broader US equity market has yet to see any significant weakness this year. With new historic highs in the Transports, Dow, NYSE Comp', and SP'500, the market continues to climb from the Oct'2011 low of sp'1074. Near term outlook is bullish, but there remains threat of a mid term rollover.

sp'monthly'9

Summary

US indexes are indeed...holding at MARCON 7.

Barring a break under the monthly 10MA - in the 1830s, and more importantly... a break of rising trend - currently around 1750, the trend remains outright bullish.

--

Update on QE

sp'monthly8

The Fed is set to announce QE taper'5 at the FOMC of June'18, with monthly QE of $35bn a month beginning in July.

If Q2 GDP comes in less than +1.0%, and certainly if it comes in negative, then I'd expect the Fed will halt QE taper, and might even raise monthly purchases in the autumn.

If the deflationary doomers are correct - with the economy slipping into a significant recession, then we could even see QE fully reverted back to $85bn a month - an annual rate of around $1trn.

After all, what else can the Fed do? Ohh yeah, they could turn interest rates negative, but then, that really would cause all sorts of quirky side effects in the financial system.

-

MARCON 6 later this year?

Even if the market maxes out this June/July, it will take a good 2-3 months for the monthly MACD cycle to turn negative - with MARCON 6.

I do not envision MARCON 5 under any scenario this year, and my core outlook is for 'broad upside' into late 2015/early 2016.