The US equity market remains strong, having effectively seen 'hyper gains' from the mid October low of sp'1820... all the way to 2075 in late November. A move to the sp'2100s looks very likely by late January 2015.

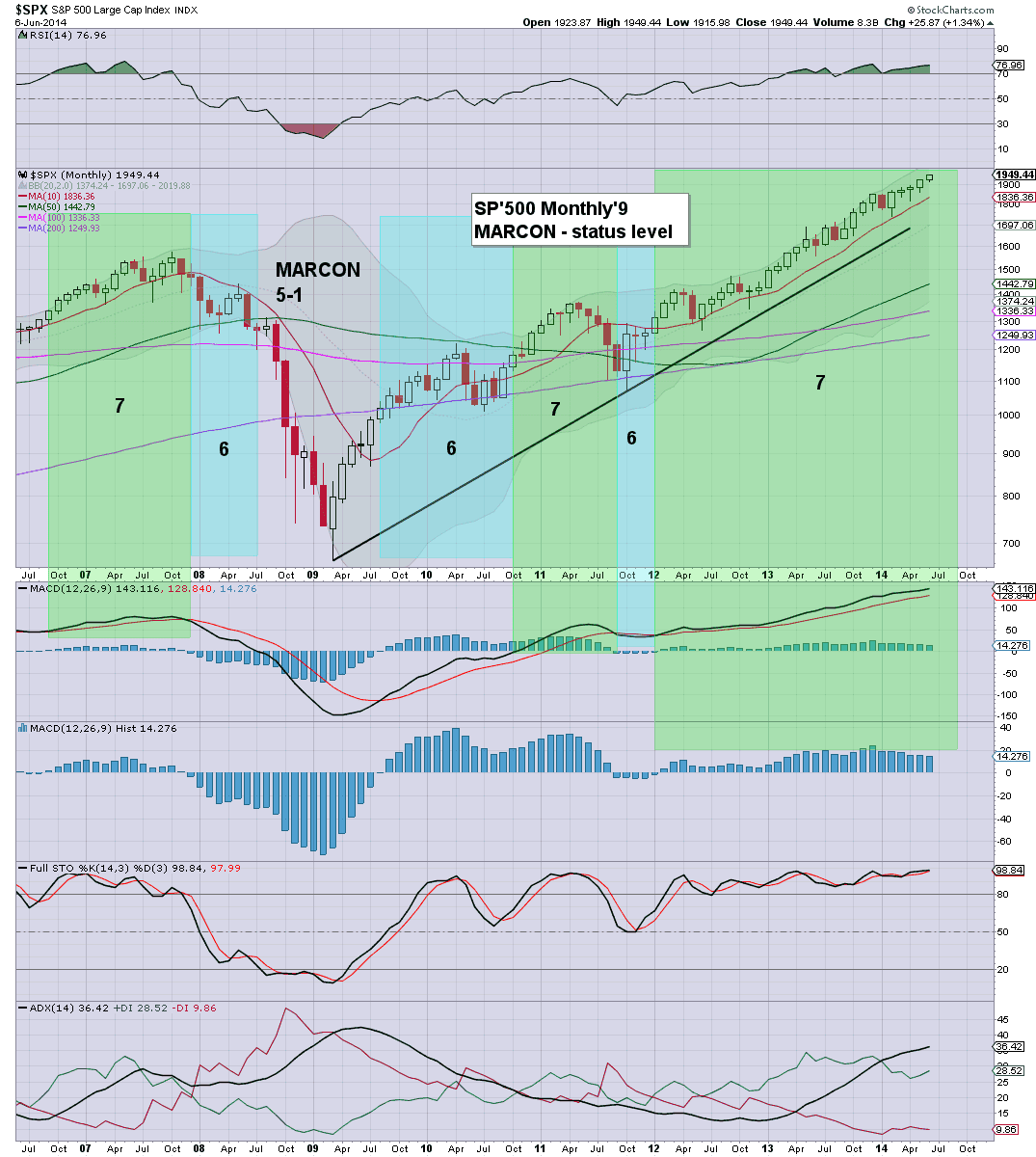

sp'monthly9

Summary

Despite the end of QE from the US Fed (with the BoJ taking up some of the slack), the broader US market is holding onto huge hyper gains since the mid October low of sp'1820.

Sustained trading under the giant sp'2000 threshold, never mind 1900 (as some are still seeking) looks highly unlikely before year end.

MARCON 6.. for mere days

It remains notable that we did see MARCON drop from 7 to 6 in October.. but it lasted mere days... and since then.. this market is holding at MARCON 7.

A break back to 6 looks unlikely for some months.

Monday, 1 December 2014

Monday, 3 November 2014

Starting the month outright bullish

US equities start a new month in an outright bullish posture, having ramped from sp'1820 to a new historic high of 2024. However, underlying price momentum is STILL swinging back toward the equity bears, but a break <sp'1900 before year end looks very difficult.

sp'monthly9

Summary

Suffice to say, with new historic highs, it is somewhat pointless to argue for a broader bearish outlook... and indeed, for the moment... I will refrain.

-

However, it is notable that despite the ramp into early November, the underlying MACD (blue bar histogram) continues to tick lower, and it is indicative that this market is way overbought, having not had a decent 15/20% correction, since the giant up wave from Oct'2011.

For the moment, sp'1900 looks to be primary support. Sure, if that fails, then the 1700/1600s are again viable, but right now... with the JCB AND the Japanese Govt' increasing their purchases of bonds and stocks (domestic AND foreign)... there is an underlying bid to most world equity markets.

It really is a case of the JCB picking up the slack from where the US Fed have left off.

sp'monthly8 - US QE phases

As we saw in mid October, it does not take much to spook the Fed officials, with Bullard being wheeled out for 'psychological support'.

The real question should arguably be... just when will QE4 begin next year... what will they be buying, and how much?

sp'monthly9

Summary

Suffice to say, with new historic highs, it is somewhat pointless to argue for a broader bearish outlook... and indeed, for the moment... I will refrain.

-

However, it is notable that despite the ramp into early November, the underlying MACD (blue bar histogram) continues to tick lower, and it is indicative that this market is way overbought, having not had a decent 15/20% correction, since the giant up wave from Oct'2011.

For the moment, sp'1900 looks to be primary support. Sure, if that fails, then the 1700/1600s are again viable, but right now... with the JCB AND the Japanese Govt' increasing their purchases of bonds and stocks (domestic AND foreign)... there is an underlying bid to most world equity markets.

It really is a case of the JCB picking up the slack from where the US Fed have left off.

sp'monthly8 - US QE phases

As we saw in mid October, it does not take much to spook the Fed officials, with Bullard being wheeled out for 'psychological support'.

The real question should arguably be... just when will QE4 begin next year... what will they be buying, and how much?

Tuesday, 21 October 2014

Back to 7 with a bounce

With the sp' climbing from 1820 to the 1940s across just five trading days, the bigger monthly cycle is back to outright bullish. However, this is not entirely unexpected, and even if the bulls can hold the mid 1900s... November will turn back to MARCON 6.

sp'monthly9

Summary

*it is notable that despite the current bounce, the Dow, R2K, and NYSE Comp', remain MARCON 6

--

Suffice to say, a bounce from the low sp'1800s into the 1900s was not unexpected, and seeing the monthly MACD (blue bar histogram) cycle turn back positive was neither surprising.

Barring a sustained move back above 1970 or so.... the monthly cycle for the sp'500 will turn negative again at the start of November.

sp'monthly9

Summary

*it is notable that despite the current bounce, the Dow, R2K, and NYSE Comp', remain MARCON 6

--

Suffice to say, a bounce from the low sp'1800s into the 1900s was not unexpected, and seeing the monthly MACD (blue bar histogram) cycle turn back positive was neither surprising.

Barring a sustained move back above 1970 or so.... the monthly cycle for the sp'500 will turn negative again at the start of November.

Friday, 10 October 2014

Major equity down wave underway

The US equity market appears to have hit a wall at sp'2019... and having now fallen to sp'1906, we've seen a rather important bearish monthly MACD cross. MARCON status is lowered to 6, for the first time since January 2012.

sp'monthly9

Summary

With the extra few points lower into the Friday close, the sp'500 saw a bearish MACD cross, and went negative (blue bar histogram) cycle on the giant monthly cycle.

... MARCON 6... for the first time since January 2012.

-

It is notable that the R2K turned MARCON 6 in July.

The Dow turned MARCON 6 at the Monday open of this past week.

--

No doubt, the sp'500 will likely bounce in the latter half of October, and MARCON status will likely have to be changed back to 7.. but still.... today was a key warning.

Market appears headed for sp'1750. If analogous to the summer 2011 retracement, then target would be 1650.

sp'monthly9

Summary

With the extra few points lower into the Friday close, the sp'500 saw a bearish MACD cross, and went negative (blue bar histogram) cycle on the giant monthly cycle.

... MARCON 6... for the first time since January 2012.

-

It is notable that the R2K turned MARCON 6 in July.

The Dow turned MARCON 6 at the Monday open of this past week.

--

No doubt, the sp'500 will likely bounce in the latter half of October, and MARCON status will likely have to be changed back to 7.. but still.... today was a key warning.

Market appears headed for sp'1750. If analogous to the summer 2011 retracement, then target would be 1650.

Tuesday, 30 September 2014

The last month of QE

Whilst US equities saw monthly net declines for September, there remains the more notable issue that QE3 (not so infinite.. after all) is coming to an end. The last of the QE fuel will be Oct'27'th... when US equities will be allowed to trade 'somewhat' more freely.

sp'monthly'8 - QE periods

Summary

Suffice to say.. it is somewhat ironic that QE3...which many called QE infinity is in fact coming to an end.

Will equities unravel as they did in spring 2010 and summer 2011?

....November onwards... will be interesting.

For now... holding at MARCON 7.

sp'monthly'8 - QE periods

Summary

Suffice to say.. it is somewhat ironic that QE3...which many called QE infinity is in fact coming to an end.

Will equities unravel as they did in spring 2010 and summer 2011?

....November onwards... will be interesting.

For now... holding at MARCON 7.

Friday, 1 August 2014

US equities increasingly vulnerable

With July ending on a pretty bearish note, US equity indexes are looking somewhat vulnerable. The R2K and Dow remain particularly weak, whilst equity bears can't be confident of a mid term top until sp' breaks into the mid/low 1800s.

sp'monthly9

Summary

This past Thursday saw the most bearish price action since early February. Of course, VIX has so far only hit the 17s, which is not exactly a particularly high level on any historical basis.

Even the low 20s look a tough challenge for August, but... if the sp'500 slips under 1900, then VIX 20s look viable.

MARCON 6 this autumn?

First, I should note, under the rules, the Dow and R2K are currently already at MARCON 6, with their monthly MACD cycles already negative. Indeed, the R2K turned negative in late July... whilst the Dow has turned negative as of August 1'st.

The sp'500 is probably at least another month or two from changing to 6.

I do not anticipate MARCON 5 for any of the indexes this year.. even if we see a major multi-month fall of 15/20%. Price momentum from the Oct'2011 low has been so very strong, that it will take an absolutely huge fall to hit the criteria for MARCON 5.

Market anticipating the end of QE3

sp'monthly8, QE phases

Two further tapers are due - Sept'18 ($10bn) and Oct'30 ($15bn), with QE3 set to fully conclude as of Oct'31st.

As is clear from chart monthly'8, in both 2010 and 2011 - within 1-3 months of QE cessation, the market saw a very significant down wave.

In the current situation of course, things are somewhat different, as QE has been gently tapered. Regardless, as the QE fuel is reduced, the underlying upward pressure to the equity market is lessened.

--

As of Friday Aug'1st... holding at MARCON 7

sp'monthly9

Summary

This past Thursday saw the most bearish price action since early February. Of course, VIX has so far only hit the 17s, which is not exactly a particularly high level on any historical basis.

Even the low 20s look a tough challenge for August, but... if the sp'500 slips under 1900, then VIX 20s look viable.

MARCON 6 this autumn?

First, I should note, under the rules, the Dow and R2K are currently already at MARCON 6, with their monthly MACD cycles already negative. Indeed, the R2K turned negative in late July... whilst the Dow has turned negative as of August 1'st.

The sp'500 is probably at least another month or two from changing to 6.

I do not anticipate MARCON 5 for any of the indexes this year.. even if we see a major multi-month fall of 15/20%. Price momentum from the Oct'2011 low has been so very strong, that it will take an absolutely huge fall to hit the criteria for MARCON 5.

Market anticipating the end of QE3

sp'monthly8, QE phases

Two further tapers are due - Sept'18 ($10bn) and Oct'30 ($15bn), with QE3 set to fully conclude as of Oct'31st.

As is clear from chart monthly'8, in both 2010 and 2011 - within 1-3 months of QE cessation, the market saw a very significant down wave.

In the current situation of course, things are somewhat different, as QE has been gently tapered. Regardless, as the QE fuel is reduced, the underlying upward pressure to the equity market is lessened.

--

As of Friday Aug'1st... holding at MARCON 7

Saturday, 7 June 2014

US equities holding strong

The broader US equity market has yet to see any significant weakness this year. With new historic highs in the Transports, Dow, NYSE Comp', and SP'500, the market continues to climb from the Oct'2011 low of sp'1074. Near term outlook is bullish, but there remains threat of a mid term rollover.

sp'monthly'9

Summary

US indexes are indeed...holding at MARCON 7.

Barring a break under the monthly 10MA - in the 1830s, and more importantly... a break of rising trend - currently around 1750, the trend remains outright bullish.

--

Update on QE

sp'monthly8

The Fed is set to announce QE taper'5 at the FOMC of June'18, with monthly QE of $35bn a month beginning in July.

If Q2 GDP comes in less than +1.0%, and certainly if it comes in negative, then I'd expect the Fed will halt QE taper, and might even raise monthly purchases in the autumn.

If the deflationary doomers are correct - with the economy slipping into a significant recession, then we could even see QE fully reverted back to $85bn a month - an annual rate of around $1trn.

After all, what else can the Fed do? Ohh yeah, they could turn interest rates negative, but then, that really would cause all sorts of quirky side effects in the financial system.

-

MARCON 6 later this year?

Even if the market maxes out this June/July, it will take a good 2-3 months for the monthly MACD cycle to turn negative - with MARCON 6.

I do not envision MARCON 5 under any scenario this year, and my core outlook is for 'broad upside' into late 2015/early 2016.

sp'monthly'9

Summary

US indexes are indeed...holding at MARCON 7.

Barring a break under the monthly 10MA - in the 1830s, and more importantly... a break of rising trend - currently around 1750, the trend remains outright bullish.

--

Update on QE

sp'monthly8

The Fed is set to announce QE taper'5 at the FOMC of June'18, with monthly QE of $35bn a month beginning in July.

If Q2 GDP comes in less than +1.0%, and certainly if it comes in negative, then I'd expect the Fed will halt QE taper, and might even raise monthly purchases in the autumn.

If the deflationary doomers are correct - with the economy slipping into a significant recession, then we could even see QE fully reverted back to $85bn a month - an annual rate of around $1trn.

After all, what else can the Fed do? Ohh yeah, they could turn interest rates negative, but then, that really would cause all sorts of quirky side effects in the financial system.

-

MARCON 6 later this year?

Even if the market maxes out this June/July, it will take a good 2-3 months for the monthly MACD cycle to turn negative - with MARCON 6.

I do not envision MARCON 5 under any scenario this year, and my core outlook is for 'broad upside' into late 2015/early 2016.

Friday, 18 April 2014

US indexes back on the rise

The decline from sp'1897, appears to have found a floor of 1814. Once again, a multi-week decline never amounted to anything more than 'minor' declines. All the main US indexes look set to close April at MARCON 7. Equity bears have at least another 2 or 3 months to wait.

sp'monthly9

Summary

Suffice to say, equity bears were teased again, with a decline of 83pts (around 4.4%) across 8 trading days.

Yes, the monthly MACD (blue bar histogram) is continuing to tick lower, but prices are still broadly climbing. Until bears can attain a monthly close under the 10MA - currently @ 1779 (the low 1800s in May), there is no justification for any excitement.

-

So, we're Holding at MARCON 7, and right now, I'd guess we won't see 6 until at least June.

sp'monthly9

Summary

Suffice to say, equity bears were teased again, with a decline of 83pts (around 4.4%) across 8 trading days.

Yes, the monthly MACD (blue bar histogram) is continuing to tick lower, but prices are still broadly climbing. Until bears can attain a monthly close under the 10MA - currently @ 1779 (the low 1800s in May), there is no justification for any excitement.

-

So, we're Holding at MARCON 7, and right now, I'd guess we won't see 6 until at least June.

Sunday, 13 April 2014

UK FTSE falls to MARCON 6, DOW set to follow

The UK equity market has rolled over, and looks set for a decline of at least 10% to the big 6k level this spring/summer. The US Dow'30 looks set to follow..as early as next week.

UK, FTSE, monthly

USA, Dow, monthly

Summary

So..we have the shaky UK market already getting a bearish MACD cross on the big monthly chart, and thus...a lowered rating of MARCON 6 - the first time since Oct'2012. Downside to the low 6000s looks a pretty easy target, whether that is this spring..or the summer.

Dow set to break 16k

The Dow remains the weakest of the USA indexes (despite the recent declines in the R2K, Nasdaq), The Dow has not seen a negative MACD (green bar histogram) cycle since Dec'2012. As ever, how we close the month, we be all important.

On any cyclical basis, we're more than due at least a moderate multi-month down wave.

UK, FTSE, monthly

USA, Dow, monthly

Summary

So..we have the shaky UK market already getting a bearish MACD cross on the big monthly chart, and thus...a lowered rating of MARCON 6 - the first time since Oct'2012. Downside to the low 6000s looks a pretty easy target, whether that is this spring..or the summer.

Dow set to break 16k

The Dow remains the weakest of the USA indexes (despite the recent declines in the R2K, Nasdaq), The Dow has not seen a negative MACD (green bar histogram) cycle since Dec'2012. As ever, how we close the month, we be all important.

On any cyclical basis, we're more than due at least a moderate multi-month down wave.

Sunday, 23 March 2014

The upward trend continues

With continuing QE (although reducing) from the Fed, US equities continue their upward trend from the Oct'2011 low of sp'1074. The issue for this year is how will the Fed react if the market gets upset, falling 15/20%? Will QE be raised, spurring a new hyper-ramp to the sp'2000s, and beyond?

--

sp'monthly8 - MARCON status

Summary

So, the market is holding at MARCON 7, and looks unlikely to drop to 6 until at least May. I do not expect MARCON 5 to be hit this year, even if the market drops to the best 'bear case' target zone of sp'1625/1575 this summer.

-

An update on the ongoing Fed QE.

sp'monthly8 - QE periods

My best guess for this year is the market becomes increasingly weak - not least due to geo-political rumblings, and we fall to the low 1600s..perhaps even (briefly) the 1500s.

I've little doubt the mainstream will get real upset at such a fall, with immense pressure on the Fed to halt taper, and actually increase QE.

Based on their past actions, I'd have to guess the Fed will indeed respond with increased QE, from a low of $35/25bn to $50/60bn a month. That would likely be more than enough to inspire a new multi-month up wave in equities.

I continue to hold to an outlook of broad upside into late 2015/early 2016. At that point, we'll very likely be trading in the sp'2000s..as outlined in the following...

sp'monthly6b

The notion of sp'2500..or higher, probably sounds like 'crazy talk' to many, but then, so was talk of sp'1500s or higher, back in late 2011. All traders - not least the equity doomer bears, would do well to keep an open mind this year.

--

sp'monthly8 - MARCON status

Summary

So, the market is holding at MARCON 7, and looks unlikely to drop to 6 until at least May. I do not expect MARCON 5 to be hit this year, even if the market drops to the best 'bear case' target zone of sp'1625/1575 this summer.

-

An update on the ongoing Fed QE.

sp'monthly8 - QE periods

I've little doubt the mainstream will get real upset at such a fall, with immense pressure on the Fed to halt taper, and actually increase QE.

Based on their past actions, I'd have to guess the Fed will indeed respond with increased QE, from a low of $35/25bn to $50/60bn a month. That would likely be more than enough to inspire a new multi-month up wave in equities.

I continue to hold to an outlook of broad upside into late 2015/early 2016. At that point, we'll very likely be trading in the sp'2000s..as outlined in the following...

sp'monthly6b

The notion of sp'2500..or higher, probably sounds like 'crazy talk' to many, but then, so was talk of sp'1500s or higher, back in late 2011. All traders - not least the equity doomer bears, would do well to keep an open mind this year.

Friday, 7 February 2014

US markets still holding the broader up trend

Despite a decline from sp'1850 to 1737, the US indexes are still broadly holding their multi-month upward trends - that stretch all the way back to Oct'2011, when the sp' was a mere 1074. MARCON remains holding at 7, but with threat of 6 in the early summer.

sp'monthly9 - MARCON phases

Summary

So, despite a multi-week index decline of around 6% - with the strongest downside intraday price action since Dec'2012 - along with VIX in the 21s, the broader trend remains outright bullish.

MARCON 7 looks likely to hold until at least April, with the sp' perhaps battling into the low 1900s.

Regardless of the near term, it does look increasingly likely that the US market will see a sizable market correction this coming summer.

Best guess: MARCON drops to 6 in the July-Sept' time frame, but then recovers to 7 late 2014/early 2015. I do not expect MARCON to hit 5..or lower, until late 2015/early 2016.

The QE continues

A reminder on the ongoing QE from the US Fed. QE taper'3 looks probable at the next FOMC of March'19. That will take monthly QE down to $55bn, but that still amounts to rather huge annualised total of $650bn.

sp'monthly8 - QE phases

--

sp'monthly9 - MARCON phases

Summary

So, despite a multi-week index decline of around 6% - with the strongest downside intraday price action since Dec'2012 - along with VIX in the 21s, the broader trend remains outright bullish.

MARCON 7 looks likely to hold until at least April, with the sp' perhaps battling into the low 1900s.

Regardless of the near term, it does look increasingly likely that the US market will see a sizable market correction this coming summer.

Best guess: MARCON drops to 6 in the July-Sept' time frame, but then recovers to 7 late 2014/early 2015. I do not expect MARCON to hit 5..or lower, until late 2015/early 2016.

The QE continues

A reminder on the ongoing QE from the US Fed. QE taper'3 looks probable at the next FOMC of March'19. That will take monthly QE down to $55bn, but that still amounts to rather huge annualised total of $650bn.

sp'monthly8 - QE phases

--

Subscribe to:

Comments (Atom)